Can investments be tax-deductible3. Let us assume Adam earns himself a net rental income of RM 5000 a month after deduction of allowable expenses his total monthly income would be RM 25000 a month or RM 300000 a year.

Media Resources Downloads Pembangunan Sumber Manusia Berhad Exemption Of Levy Order 2001 Kwsp 3rd Schedule 7 For Period Apr 2020 To December 2020 Gst Income Tax Forms Gst Forms Epf Kwsp Forms Socso Perkeso Forms News

In this case if the marginal tax bracket falls at 22 and you rent out a property for 5000.

. Hence it is important for property investors to understand the actual taxation on rental income before they start to rent their property out. Property investors beware. According to LHDN they include.

Rent must be paid in full. B Legal cost and stamp duty for initial tenancy agreement. Rental income is taxed at a flat rate of 26.

A mortgage loans interest rate. Industrial Building Allowance 28 12. Gross rent minus any allowable expenses in which you can opt for a 15 deemed rental expense deduction on top of mortgage interest.

The calculation of rental income is done on a net basis which means that certain deductible expenses will reduce the amount. Expenses incurred on rent collection. Accommodation fees on a tourist accommodation premises registered with the Ministry of Tourism Arts and Culture Malaysia.

This was introduced in Section 4 d of the Income Tax Act 1967 ITA. Rental Income Received in Advance 18 10. Must be evidenced by a registered medical practitioner or written certification of a qualified carer.

Malaysia Income Tax Deduction YA 2020 Explained. The legalese gets complicated so lets break. What is deductible against rental income5.

However there are specific deductions allowed such as incorporation expenses and recruitment expenses conditions apply. Letting of Part of Building Used in the Business 28 14. The Australian Taxation Office ATO has revealed the four key areas it will be targeting this tax year and rental property incomedeductions and capital gains are high.

100 US 400 MYR. Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit rent and agents commission. Legislated to allow certain specific expenses an income deduction notwithstanding such expenses do not satisfy the allowable business expenses criteria.

C Real estate agent commission to secure the. Chances are the portion of Adams tax on his rental income would be 24 or 245 if he chooses his income to be taxed individually and he has little personal. A tax deduction reduces the amount of your.

Non-deductible expenses are initial expense because it is incurred to create a source of rental income and not incurred in the production of rental income. November 20 2021. What expenses can be deducted from rental income in Malaysia2.

Now in 2019 the time has come for property owners to begin claiming that exemption on their income tax forms. Usually pre-filled in your income tax form or claim the actual amount of. The following expenses can be deducted from rental income in Malaysia.

A company is tax resident in Malaysia for a basis year if. Expense Relating to Income of Letting of Real Property 13 9. However those rental income are taxable based on Malaysia Taxation Law.

Capital Allowance 25 11. The expenses that are income tax deductible including. Income from the letting of real property in Malaysia is named as rental income and is chargeable to tax under section 4 d of the.

Medical treatment special needs and carer expenses for parents. When you earn less than 2500 a year from property rental you must contact HMRC but if your income is between 2500 and 9999 after expenses you must file a self-assessment tax return. As an ordinary income rental income is taxed.

The idea is that income from the renting of residential properties would receive a 50 exemption from income tax. Expenses on repairs and property maintenance. Rental Income Deductible Expenses.

For instance they include. So what are these deductible expenses for rental income. Interest expense is allowed as a deduction if the expense was incurred on any money borrowed and employed in the production of gross income or laid out on assets used or held for the production of gross.

Includes care and treatment by a nursing home and non-cosmetic dental treatment. Is management fee tax-deductible in Malaysia4. 2 Exchange rate used.

IRAS taxes you on the net rental income ie. Replacement Cost of Furnishings 28 13. Special relief for domestic travelling expenses until YA 2021.

Stay in Malaysia less than 182 days are taxed at flat rate of 28 without. What Expenses Can Be Deducted From Rental Income In Malaysia. Examples of initial expenses are-.

This tax applies to assessments. A progressive tax rate of 0 - 28 applies to Malaysias rental income. 4 Rental income earned by nonresident individuals is taxed at a flat rate of 25.

Income-generating expenses such as quit rent assessment repairs and maintenance fire insurance service charge sinking fund and management fees are deductible. Additional deduction of MYR 1000 for YA 2021 increased maximum to MYR 3000. It can be derived from immovable properties and movable properties.

Depreciation does not qualify for tax deductions. Interest on home loan. A Advertising cost to secure the first tenant.

Updates and Amendments 28 15. Before declaring your rental income to LHDN you should start from the rental income sources. Expenses incurred on rent renewal.

Technical fee rental of movable property payment to a non-resident public entertainer or other payments made to non-residents. Entrance fees to tourist attractions. Nonresidents are taxed at a flat rate of 26 on their Malaysian-sourced income.

Types Of Taxes In Malaysia For Companies

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

Tax Planning On Rental Income Afc Chartered Accountants Audit Tax Advisory And Accounting

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

8 Things To Know When Declaring Rental Income To Lhdn

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

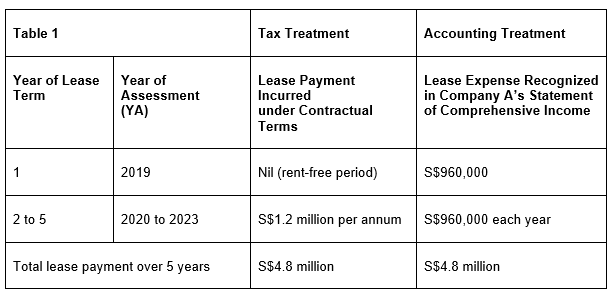

Tax Treatment For Rental Of Business Premises Crowe Singapore

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Computation Of Buss Income Computation Of Statutory Business Income For Ya Rm Net Profit Before Studocu

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Malaysian Income Tax 2017 Mypf My

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

Tax Planning On Rental Income Afc Chartered Accountants Audit Tax Advisory And Accounting

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Special Tax Deduction On Rental Reduction

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

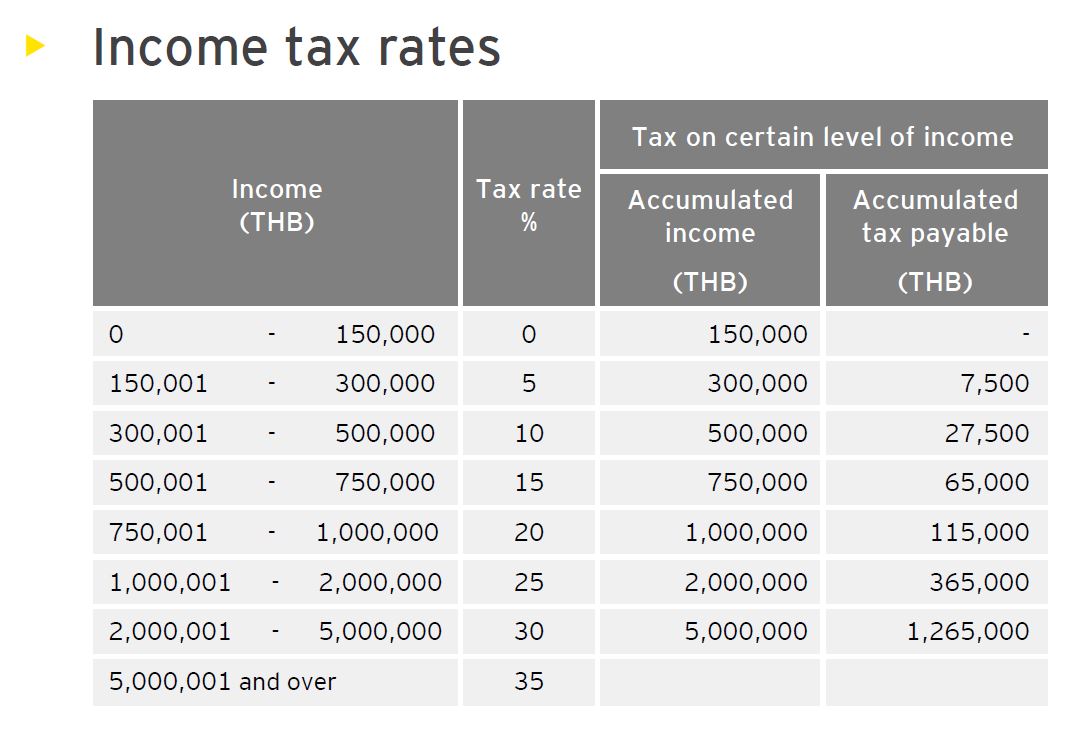

Real Estate Taxation In Thailand Thai Property Group

Tax Planning On Rental Income Afc Chartered Accountants Audit Tax Advisory And Accounting